HOA Detective™ | October 10, 2025: For more than four decades, the Community Associations Institute (CAI) has positioned itself as the de facto policy voice for the nation’s homeowner and condominium associations. Yet, in 2025, the organization abruptly reversed course on one of its longest-standing tenets: a so-called ‘hands-off’ approach to reserve funding and reserve study policy.

After years of maintaining that funding adequacy was a state issue, CAI is now presenting itself as the guiding conscience of the nationwide HOA industry – an institution that, by its own inertia, helped create the very crisis it now pretends to solve.

The About-Face: The CAI’s May 2025 update to its Reserve Study and Funding Public Policy marks a dramatic about-face. For decades, CAI avoided taking firm positions on reserve funding mandates, preferring vague language about ‘best practices’ and ‘board discretion.’ However, in the wake of the Champlain Towers South collapse in Surfside, Florida – a catastrophe that claimed 98 lives – the organization found itself on the defensive.

With the blood of 98 people on its hands, CAI is recasting itself as the enlightened authority it long refused to be. The new policy language emphasizes state legislative reform, mandatory funding transparency, and periodic professional reserve studies. These are commendable principles – but they come at least two decades too late. For years, CAI and its members dismissed or minimized warnings from independent analysts who called attention to the growing wave of underfunded homeowner associations across the country.

Longstanding Warnings Ignored: One of the most persistent voices in this wilderness has been Robert M. Nordlund, PE, RS – founder of California-based Association Reserves, and in some respects a well, connected industry insider.

For close to thirty years, Nordlund has published data showing that approximately 70–75% of all U.S. HOAs are underfunded in their reserves. His company’s empirical data, drawn from tens of thousands of studies, paints a sobering picture of systemic financial neglect.

Yet for most of CAI’s history, such findings were treated as inconvenient truths, quietly filed away while the organization focused on lobbying, credentialing, and self-promotion.

Meanwhile, independent firms such as Capital Reserve Consultants (CRC) – reserve planning consultants who introduced the concept of HOA due diligence almost 15 years ago, and have more recently launched The HOA Detective™ blog, were raising a similar alarm.

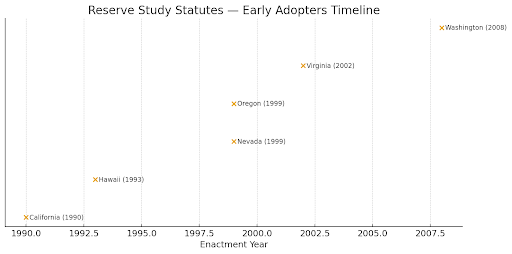

Since 2006, CRC has analyzed and documented the predictable depreciation of building systems, the mismatch between useful life assumptions and actual conditions, and the recurring theme of underfunded replacement reserves. Not only on the West Coast, where the reserve study concept was first introduced into the statutes of forward-thinking states, but throughout the country.

Back in 2009 CRC principles completed a “lap around Florida” during which numerous buildings were toured for the purposes of gaining insights into the local conditions and opportunities for a reserve study service provider like CRC. To state that the conditions were appalling would be understating the situation.

CRC’s Rejected Warnings: Fresh off this fact-finding excursion CRC submitted a proposal to present at the 2010 CAI National Conference – a workshop session titled ‘2020 the HOA Tipping Point.’

Simple Premise – Profound Prophecy: Using the US Census Bureau’s 2007 American Housing Survey CRC concluded that by the year 2020, a critical mass of U.S. HOAs would be in serious financial distress. A high percentage of all U.S. HOAs would be at least 20 years old, many much older than 20 years.

According to the Tipping Point thesis, deferred maintenance would collide with underfunded reserves, aided and abetted by an apathetic industry and state legislators who had been trained to follow the lead of industry policy-making establishments such as CAI, NAHB, and the NAR.

If the hypothesis set forth in CRC’s thesis was correct, the year 2020 would be a monumental turning point for the nation’s 350K-plus common interest developments. Lack of reserves and decades of deferred maintenance would leave aging properties vulnerable to physical failure, declining property values, and insurability issues.

The CRC proposal was politely rejected as an “exciting proposal,” perhaps too exciting? In hindsight, the rejection stands as a poignant symbol of institutional denial – the refusal of an industry gatekeeper to hear the uncomfortable truth, or as former Vice President, Al Gore would have called it, an “Inconvenient Truth.”

Right on Schedule: In June of 2021 Champlain Towers South (CTSC) collapsed, almost as if the event had been scripted. Not only was it an appalling tragedy; it was the inevitable endpoint of decades of ignoring the critical role of long-term reserve planning and funding of replacement reserves by an HOA status quo consumed by an unjust sense of self-importance.

In the end, forty years of deferred maintenance, and collective industry apathy is what caused the CTSC to collapse in the early morning hours of June 24, 2021, killing 98 occupants of the building. (RIP and condolences to the survivors).

When the dust finally settled, the pile of rubble served as a gruesome conformation of CRC’s 2010 Tipping Point thesis. This most catastrophic disaster COULD and WOULD have been prevented by a proactive response by industry thought-leaders like CAI, to say nothing about the Floridia Legislature.

Bitter Vindication Begets Tragedy: The post-Surfside period has proven both Nordlund and CRC correct. As the U.S. condominium stock ages much of it built in the 1970s and 1980s, associations are facing massive repair bills that far exceed their reserves. Multi-million-dollar loans, once rare, have become commonplace.

Serial Special assessments are now commonplace throughout the country, not only because of mismanagement, but because of structural reserve underfunding baked into the DNA of the HOA.

These outcomes are not anomalies; they are the direct and predictable result of industry complacency. For decades, CAI-trained managers, attorneys, and board members perpetuated a culture of financial minimalism — keeping dues low to appease owners while deferring the inevitable. As The Detective’s late father would have said, “You can kick the can down the road, but eventually you run out of road.”

Due and Payable: For many U.S. HOAs the deferred maintenance bill has come due, CAI’s newfound activism is nothing less than an acknowledgment that too many HOAs have indeed, reached the end of the road, that CRC’s Tipping Point proclamation was true, and that it was a mistake to ignore the warning from Robert Norlund that 3 out of 4 U.S. HOAs were severely underfunding their replacement reserves.

Reinventing Reality: CAI’s May 2025 public policy revision, unveiled with much fanfare, reads as though the organization has just discovered the concept of fiscal sustainability. In all candor, it is an example of carefully crafted political theater designed for reputation management purposes, first and foremost. A strategic policy pivot designed to preserve credibility in the wake of public outrage. By positioning itself as the newfound thought leader on reserve adequacy, and the importance of reserve planning, CAI seeks to obscure its historical complicity in the very problem it now condemns.

Where was CAI in 2010, for example, when Florida Legislature repealed a 2008 law under pressure from developers and the community management lobby that required all condominium buildings of three stories or higher to undergo a structural condition assessment every five years? In other words, a law that would almost CERTAINLY have prevented the collapse of the CTSC.

This irony is difficult to ignore. The same organization that once treated mandatory funding standards as politically toxic now insists it has always advocated for responsible reserve planning. The truth, of course, is more complicated – and less flattering.

Lessons and the Path Forward: For those of us who have spent decades studying the slow decay of America’s HOA infrastructure, CAI’s about-face offers vindication and frustration, but most of all it offers hope. It validates the warnings issued by independent analysts long before Surfside. But it also highlights the institutional inertia that allowed the crisis to fester. If CAI is going to reset the bar for reserve studies, and position itself as the all-knowing expert on the topic of reserve planning, the new standards and policies must establish the following minimum standards if genuine reform is to occur:

- Statutory definition of what qualifies as a reserve study.

- Mandatory reserve studies that meet the definition.

- Mandatory ANNUAL reserve studies updates.

- Statutory minimum funding levels.

- Truly independent, objective reserve planning by consultants that are not beholden to or owned by management companies, or consultants with ongoing business relationships with the reserve study client.

- Mandatory structural inspections of buildings that meet height/age criteria.

- Mandatory baseline property condition assessments, based on recognized standards, performed by qualified experts.

- Peer-review or second-party validation of ALL reserve studies.

- Independent auditing of HOA finances – not reviews, AUDITS!

- Random assignment of auditors (no more 20-year audit engagements).

- Statutory enforcement mechanisms to ensure compliance by all parties.

- Tailoring of the standards to “fit” the property classification (see below).

A five-unit, single level condominium building that is ten years old should not be held to the same standard as a forty-year-old, 12-story condominium located 200 feet from the mean high tide such as the CTSC.

Conclusion: History will likely record CAI’s 2025 policy reversal as a turning point – not in leadership, but in credibility. The truth is that the turning point should have occurred thirty years ago when states like California, Oregon, Nevada, and Hawaii passed the nation’s first reserve study laws.

The Inconvenient Truth is that CRC was correct in 2010, and Robert Norlund has been correct all along. If the guardians of the HOA industry had listened, instead of having to be dragged, kicking, and screaming into a conversation about accountability and responsible stewardship, the public would be safer, and 98 people in Surfside, FL may well be alive today.

Because You’re Buying More Than a Home!